Wall Street Journal’s decision to include AI in several processes has made waves across the world. The WSJ is now frequently associated with headlines like AI in algorithmic portfolio management and AI analysts.

The Ripple Effect of a Downturn: From Wall Street to Asia

It is speculated that the WSJ will be using AI for financial modeling and risk assessment. The tremors of this shift are now shaking the Asia-Pacific market, mostly affecting the chip making industry. The domino effect has once again shown how closely knit the global financial market is.

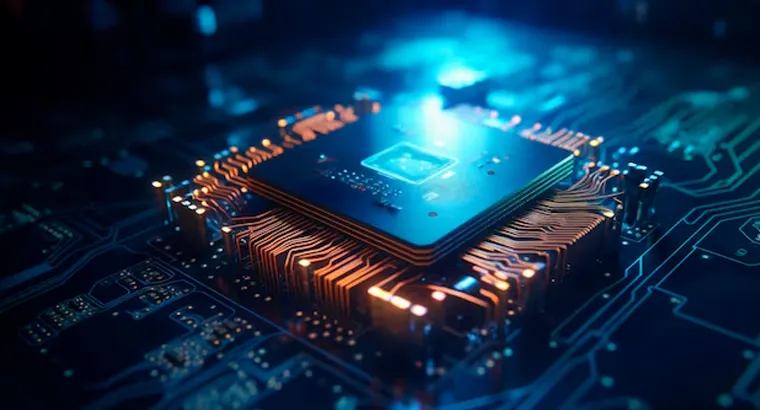

The primary catalyst for the reminder is the dip in Nvidia share prices. Over the weekend, the tech giant lost share value, which led to a quick sell-off in Asian chip shares at the week’s start.

The sell-off was not solely driven by Nvidia as it also shed light on the broader concerns regarding AI’s future in the industry. This market correction significantly impacted Taiwan and South Korea, two major chipmaking hubs.

A recent report highlighted that South Korean chipmakers, such as SK Hynix, a major supplier of Nvidia HBM chips, fell as much as 3.6% before recovering to 3.3%. Samsung Electronics, a supplier of high-bandwidth memory (HBM) chips to the American chipmaker this year, fell 2.3%.

Looking Ahead: A Broader Market Analysis

The market development has echoed the already-loud question: Is the AI boom losing fuel? New reports hint at potential concerns surrounding the sustainability of AI in the financial market.

The most recent reaction of the market may be interpreted as a sign or a transient state of uncertainty. At this time, nothing can be said with certainty.

Regardless, the latest episode exposed the vulnerable nature of the Asian chip making industry. The price drop highlights how the market is prone to fluctuations, even among the worldwide tech mammoths. Their dependence on brand status, such as Nvidia, makes them vulnerable to external anomalies.

In the coming time, gradual diversification and innovation will be pivotal for the Asian chip market to address upcoming challenges. According to analysts, a global chip shortage is likely to remain in the market for at least one year.

It allows the chipmakers to further solidify their market reach and share. The chipmakers should embrace a holistic approach, invest in the research and development of next-gen technologies, and expand into quantum computing.

This way, they can develop resilience and make sure they experience long-term growth in the evolving technological space.